Introduction

There’s always a lot of talk about wealth inequality in America. Over the last decade and a half we’ve seen Occupy Wall Street, Eat The Rich, and plenty of anti-wealthy-people sentiment less pithily expressed.

While a reasonable person likely doesn’t think that all wealth is bad or every wealthy person is evil and should be stripped of their money through legal or illegal means, the general antagonism is real and widespread.

What I’d like to discuss here is a taxonomy of the wealthy. I believe that there are very important distinctions to be drawn between different ways of becoming wealthy, that some of them are more moral than others, and that the discussion of capitalism and wealth inequality in general needs to account for these differences.

A Taxonomy of the Wealthy

I intend first to generate something of a logical taxonomy, distinguishing between kinds of wealthy people by logical categories, before diving into the data.

First, we divide the wealthy into two categories: those who inherited their wealth versus those who became wealthy. More specifically, is a majority (>51%) of someone’s wealth something that was handed to them by circumstances outside their control, or did they gain most of their wealth over the course of their life through their own actions?

Second, among the people who gained most of their wealth over the course of their life, did they create that wealth through positive-sum interactions (i.e. creating companies or products that people value and buy) or did they extract that wealth through zero- or negative-sum interactions (i.e. property ownership, government contracts, rent-seeking in all its forms)?

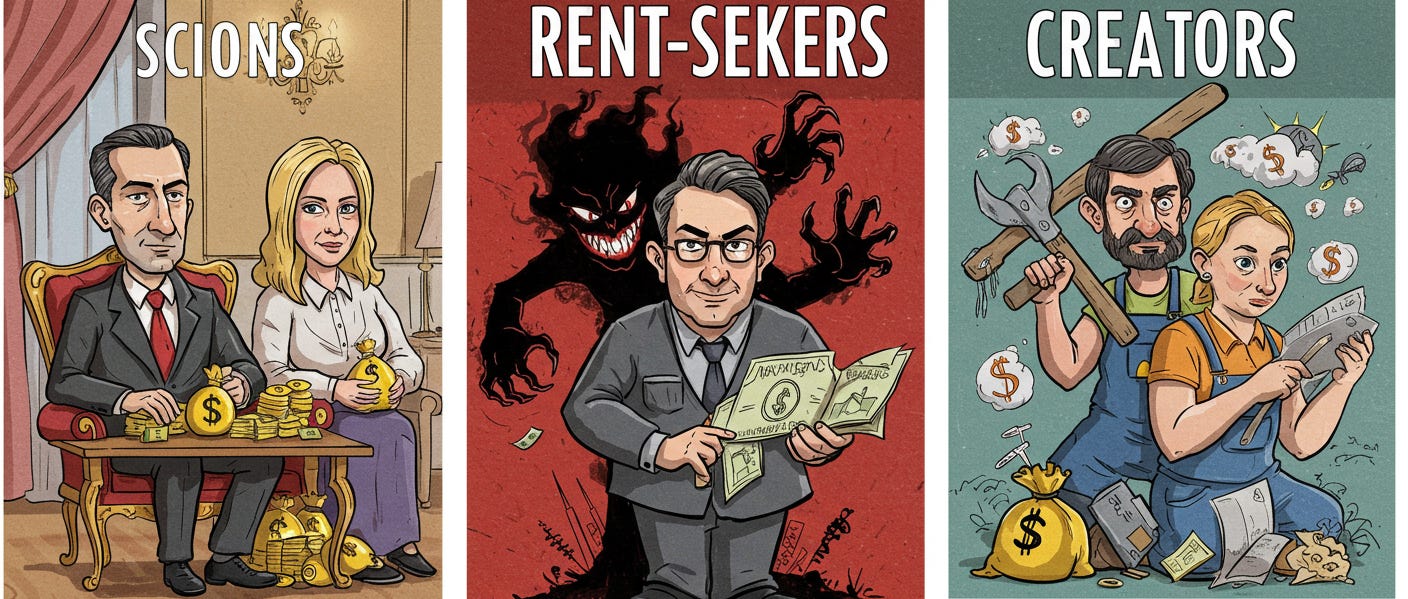

This gives us three categories to work with:

Scions

People who inherited wealth

Rent-Seekers

People who become wealthy through extracting or monopolizing value, not creating it

Creators

People who become wealthy through creating value and capturing some percentage of it

Each of these categories is importantly different, even though there is overlap between them. We’ll discuss each separately.

Scions

Scions are people who are wealthy because their family is wealthy. Think Kennedy, Rockefeller, Clinton children, and so on. Donald Trump and Elon Musk were both given substantial wealth from their families when starting out, without which they may not have had the successes that they did, although they don’t fit into this category exactly.

Scions also include royalty, Sheiks, and the like.

When it comes to scions, we want to balance two competing impulses.

First is the impulse to use inheritance taxes to take unearned money away from those who don’t deserve it.

Think about it: a scion has done nothing to deserve their wealth. They didn’t add to the world or create value in any way; they were literally just born to the right family. There’s a sense of injustice here, a whiff of unearned inequality. A scion gets to enjoy the benefits of more wealth than most can dream of, because…they won the birth lottery? At least with actual lotteries, you’ve got to spend money to buy a ticket; these people are rich just because they were born.

Second, our economy and capitalism in general run on people wanting to become wealthier. This is an incentive structure that has greatly benefited humanity, for all the issues it’s caused along the way. It’s responsible for the myriad material advances that make our bodies safer and healthier than humans have ever been. But part of that incentive - one of the reasons a person has to amass wealth, in a world where no amount of wealth will make you immortal - is the incentive to pass that wealth on to your children. People want their children to be happy and healthy and safe, and part of that is wanting them to be the beneficiary of one’s own efforts once they’ve passed.

How do we balance our intuitions about the injustice of unearned wealth with the necessity of preserving the incentives people have to grow wealthy and contribute to the economy?

This is difficult, but my intuition leans in the direction of discouraging (via heavy taxation) inherited wealth. Due to regression to the mean, children of extraordinarily wealthy individuals are not as likely as their parents to have whatever combination of extraordinary traits that led to their parents’ wealth. Putting large sums of money in their hands is not all that much better than putting it in anyone else’s.

This means we want large estate and inheritance taxes, and to close the tax loopholes that allow people to get around these. The most well-known loophole that needs closing is the step-up in basis provision. As per Claude:

This allows inherited assets to be valued at their fair market value at the time of death rather than their original purchase price. When heirs sell these assets, they only pay capital gains tax on appreciation that occurs after they inherit, effectively erasing all capital gains that accumulated during the deceased person's lifetime.

For wealthy families, this means significant appreciation in assets like stocks, real estate, or business interests can escape both income and estate taxation. When combined with other strategies like trusts and family limited partnerships, this provision helps many high-net-worth individuals significantly reduce their estate tax liability.

The step-up provision is particularly powerful because it applies even when estates aren't large enough to owe estate tax at all.

Of course, this is only in the US. The UAE has little interest, I suspect, in making such changes.

It’s important to understand that we’re likely never getting rid of scions entirely. Wealthy people are going to do everything they can to keep and increase their wealth; that’s why they’re wealthy to begin with. That being said, I think Scions are a particularly egregious case of unearned wealth, and so measures to reduce the amount of wealth they inherit are welcome.

Keep in mind this may actually benefit most scions; for every scion who manages to increase the family fortune, how many languish under an individual version of the resource curse that countries suffer from? How many become addicted to drugs or other diversions, how many feel a deep ennui from knowing that they don’t have to ever struggle or try in their lives?

Rent-Seekers

I’ve addressed rent-seeking in general before. It’s a huge pet peeve of mine, as I think it’s importantly different from other methods of generating wealth and the real culprit behind a lot of what capitalism gets blamed for.

To recap: a rent-seeker is someone who gains wealth through extracting or monopolizing existing value, rather than creating something new. The toy example I like to use is that of a Troll that takes up residence on a bridge, charging passengers for crossing it. The Troll didn’t build the bridge; they don’t maintain it or help travelers cross it faster. They just extract wealth from travelers by threatening them with violence, taking advantage of naturally occurring resources and the work of others.

Real-world examples of rent-seekers are many and varied:

Most landlords provide some nonzero value above just owning the land on which their tenant resides, but a large portion of their wealth comes from rent-seeking (bonus points in that they literally seek rent payments).

Scientific journals that charge money for access to their databases are rent-seekers. They didn’t write the papers they publish, nor do they pay for peer review. While they do host the data and provide an interface to access it, the fees they charge for access are way in excess of those costs. They are holding scientific knowledge - often funded with taxpayer dollars - hostage for money.

Regulatory capture is a kind of rent-seeking. Any company that lobbies for laws that advantage it at the expense of its competitors is rent-seeking.

The Jones Act, for instance, is a form of rent-seeking. The way that homeowners use NEPA lawsuits to prevent development and preserve their property values is a form of rent-seeking (example case here). Disney lobbying for copyright length extensions is a form of rent-seeking.

Rent-seeking is the most unambiguously immoral form of gaining wealth, beyond literal exploitation, slavery, and murder. Most of the economic and regulatory changes I champion revolve around reducing or eliminating forms of rent-seeking.

The Land Value Tax reduces/eliminates rent-seeking from owning land. My vague proposal for reforming NEPA is about trying to make environmental protection laws that can’t be abused by rent-seekers.

Creators

It’s one of the fundamental axioms of capitalism that, if two people are willing to engage in a voluntary trade, then each must value what the other has, at minimum, at the price of what one is exchanging for it. In other words, if I pay $5 for a dozen eggs, I value those eggs at least as much as I value the $5, and likely a little more, given that I would’ve been willing to pay $5.01 for them.

This kind of voluntary trade creates value (technically consumer and producer surplus).

When someone creates something other people are willing to pay for, from a book to a car to a new kind of vaccine, they’ve created value that others are willing to pay for. These people have added to the economy, and it’s my personal belief that they deserve to benefit from the fruits of their labor. Key to this is that the amount they benefit is essentially unlimited - if they create a trillion dollars’ worth of value, I’m perfectly happy for them to become a trillionaire. They created that value, and people were willing to pay for it; nothing immoral happened.

Thus creators are the only category of people where wealth is genuinely moral. Riches should flow to the people who create things of value; that is literally the point of capitalism. It boosts the economy and enriches us all when this happens, because it creates the incentive for people to contribute, innovate, and create.

AI Research

I asked Claude to use the above taxonomy to classify the top 10 wealthiest individuals in the world. The following is AI-generated:

Wealthiest People: A Detailed Taxonomy of Wealth Creation

Analyzed through the lens of Scions, Creators, and Rent-Seekers, as defined in the original taxonomy:

Bernard Arnault (France)

Primary Category: Mixed (Creator with Scion Characteristics)

Inheritance: Son of a successful construction company owner

Wealth Generation:

Created massive value by building LVMH into a global luxury goods conglomerate

Leveraged family business connections and initial capital

Primarily a Creator who used inherited advantages to scale his wealth

Taxonomy Nuance: Demonstrates how inherited advantages can fuel value creation

Elon Musk (USA)

Primary Category: Mixed (Scion with Strong Creator Tendencies)

Inheritance:

Father owned an emerald mine in Zambia

Received substantial early financial support (estimated ~$28,000)

Wealth Generation:

Created significant value through Tesla, SpaceX, and other innovative companies

Transformed inherited advantages into groundbreaking technological innovations

Taxonomy Nuance: A complex case of inherited wealth transformed through innovation

Jeff Bezos (USA)

Primary Category: Creator

Inheritance: Modest family background

Wealth Generation:

Revolutionized e-commerce and cloud computing with Amazon

Created unprecedented economic value through technological innovation

Taxonomy Nuance: Closest to the ideal "Creator" in the original taxonomy

Wealth generated through positive-sum interactions

Minimal inherited business advantages

Larry Ellison (USA)

Primary Category: Creator

Inheritance: Adopted, no significant inherited wealth

Wealth Generation:

Founded Oracle Corporation

Created substantial value in enterprise software and technology

Taxonomy Nuance: Exemplifies "pure" creator status

Wealth generated entirely through innovation and business creation

Mark Zuckerberg (USA)

Primary Category: Creator (with Potential Rent-Seeking Elements)

Inheritance: Upper-middle-class professional family

Wealth Generation:

Created Facebook (Meta), transforming social media

Controversial elements of value extraction through data monetization

Taxonomy Nuance: Blurred lines between creation and value extraction

Innovative platform creation

Potential rent-seeking through data monopolization

Carlos Slim Helú (Mexico)

Primary Category: Rent-Seeker

Inheritance: Immigrant entrepreneurial family with business background

Wealth Generation:

Gained wealth through monopolistic practices in telecommunications

Extensive use of regulatory capture and market manipulation

Taxonomy Nuance: Quintessential rent-seeker

Wealth primarily extracted through monopolistic practices

Minimal value creation, maximum value extraction

Bill Gates (USA)

Primary Category: Creator

Inheritance: Upper-middle-class professional family

Wealth Generation:

Founded Microsoft, revolutionizing personal computing

Later created significant value through philanthropic efforts

Taxonomy Nuance: Strong creator with social value generation

Technological innovation

Subsequent charitable work creating global social value

Warren Buffett (USA)

Primary Category: Mixed (Creator with some Rent-Seeking)

Inheritance: Father was a stockbroker with business connections

Wealth Generation:

Created value through intelligent investment strategies

Some wealth generated through strategic market positioning

Taxonomy Nuance: Sophisticated value creation with elements of strategic rent-seeking

Investments that both support and potentially extract value from existing economic structures

Larry Page (USA)

Primary Category: Creator

Inheritance: Academic professional family

Wealth Generation:

Co-founded Google, transforming internet search and technology

Created massive economic and technological value

Taxonomy Nuance: Pure creator archetype

Technological innovation

Fundamental transformation of information access

Mukesh Ambani (India)

Primary Category: Mixed (Scion with Creator Elements)

Inheritance: Son of Dhirubhai Ambani, founder of Reliance Industries

Wealth Generation:

Inherited massive business empire

Significantly expanded and transformed family business

Taxonomy Nuance: Classic example of a scion who became a creator

Started with inherited wealth

Created substantial additional value through business innovation

Taxonomy Breakdown

Creators: 4 (Bezos, Ellison, Gates, Page)

Rent-Seekers: 1 (Slim)

Mixed Categories: 5 (Arnault, Musk, Zuckerberg, Buffett, Ambani)

Pure Scions: 0

When asked about the top 100 wealthiest people, Claude had these insights to share:

Primary Categories

Creators: 62% (62 individuals)

Mixed Category: 30% (30 individuals)

Rent-Seekers: 8% (8 individuals)

Wealth Origin

First-Generation Wealth: 72%

Inherited Wealth: 28%

Non-AI Commentary

I don’t entirely agree with Claude - I think that Zuckerberg and Gates owe a bit more to rent-seeking than it seems to - but fundamentally I think it gets the point across that vast wealth comes mostly from value creation, not rent-seeking or inheritance. Scions and rent-seekers can be millionaires, but don’t make up a large percentage of billionaires.

The best way to get super-wealthy is still to create something extremely valuable, like an IP (Harry Potter) or company (Amazon).

Conclusion

Wealth is not inherently immoral, not even outrageous sums of it. Whatever corrupting properties it may or may not possess, being a billionaire is not necessarily a bad thing, and billionaires are not policy errors.

There is nuance, as there is in all things. The question that must be asked is: how did the person become wealthy?

If someone became wealthy through inheritance, they’re a Scion, and while their wealth isn’t evil it is nonetheless undeserved. This is something that can be mostly rectified through improving existing inheritance taxes, although some measure of inheritance isn’t a bad thing, as it preserves people’s incentives to become wealthy in the first place.

If someone becomes wealthy through rent-seeking, that wealth is immoral and should be taxed away from them if possible. Ideally they wouldn’t have been able to become wealthy that way in the first place, but that’s not the world we live in. Do note, however, that most rent-seeking in the real world involves government intervention into the market. Governments enable large portions of rent-seeking, whether by protectionist laws or failing to tax land ownership sufficiently.

If someone becomes wealthy because they created something that other people value highly, that’s good: that’s the system working as intended, and how humanity dragged itself out of the Malthusian trap that kept 99% of it in a state of abject poverty for thousands of years. Most of the super-wealthy people in the world today have created a large percentage of their wealth this way, based at least on a cursory examination of the facts.

Undeserved?